I spent an hour this morning speaking with some brokers as part of our regular check-in. It was a timely and constructive discussion, focused on positioning and perspective rather than reacting to headlines and noise.

A couple themes stood out.

For an equity market that has experienced only a mild correction, the level of angst is striking. Long periods of exceptional and unusually smooth returns have left some investors poorly conditioned for even modest drawdowns. Discomfort now feels unfamiliar. For us, this is precisely when discipline matters most and why we are selectively buying the dip.

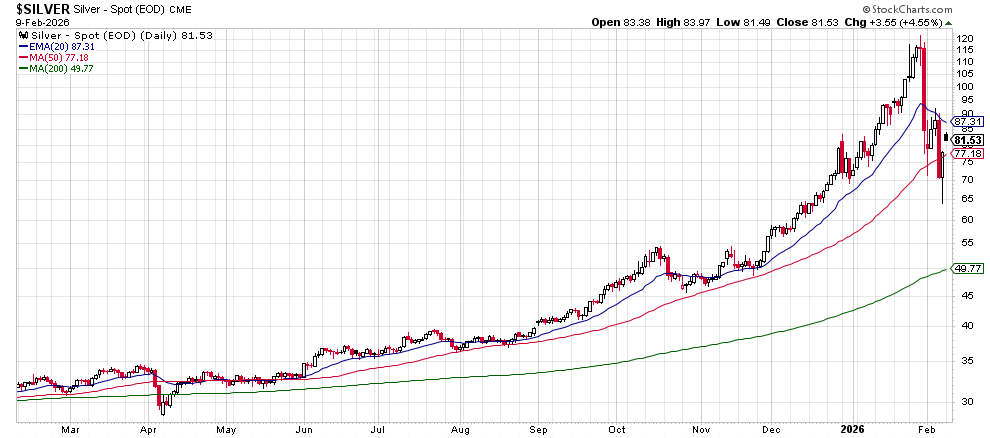

If you chased silver above $100 on a wave of FOMO, the recent drawdown likely felt painful. Our allocation to precious metals was initiated more than a year ago, reflecting patience and risk management rather than enthusiasm at the top. Corrections have a way of clarifying the difference.

We also discussed the growing weakness in software stocks. Last Thursday, the software and services sector saw its share of total S&P 500 market capitalization fall below 9% for the first time since July 2011. We are watching closely for what this shift may open up.

For newer participants in Bitcoin, the recent price plunge may feel alarming. To us, it is familiar territory. We have been gradually reducing exposure to digital assets since last year in response to our signals, well before sentiment cooled and the headlines caught up.

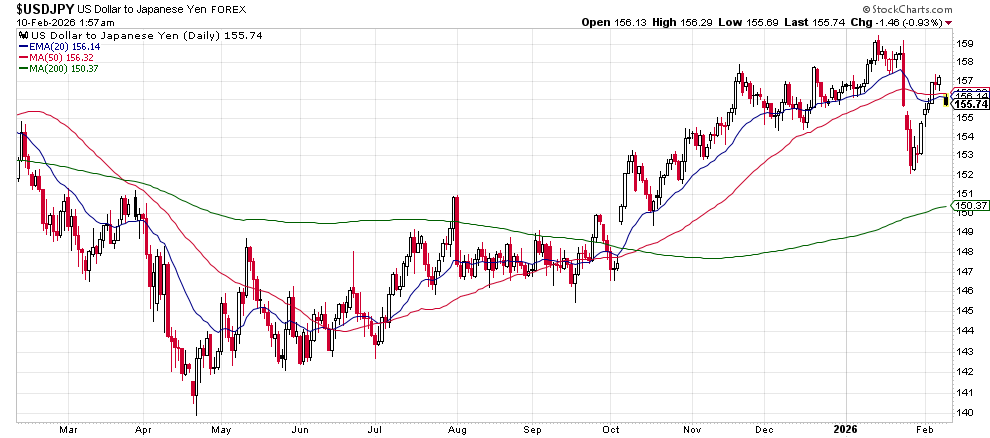

On the global front, Takashi’s landslide victory in Japan did not disappoint. With that outcome largely priced in, our attention is now turning toward identifying tactical trading opportunities in the Yen.

Oh finally, President Trump’s nomination of Kevin Warsh to replace Jerome Powell as Federal Reserve Chair in May has generated plenty of discussion on Wall Street. We spent time considering potential market scenarios under a Warsh-led Fed because markets tend to adjust expectations long before policies actually change.

In short, volatility has returned, emotions are elevated, and patience is once again being tested. Against this backdrop, our positions are sitting comfortably in better-than-expected gains since the beginning of the year, which allows us to stay selective, flexible, and disciplined.